29 Nov 2022

ZCTU 2023 National Budget Review

Introduction

The National Budget comes at a time when the economy has been experiencing some measure of macroeconomic stability as been shown by the significant fall in the monthly inflation figures from 30.7% in June 2022 to 3.2% in October 2022, while annual inflation has decelerated from 285% in August 2022 to 268.8% in October 2022. The annual inflation rate however still remains quite high and this has disproportionately affected the working population the majority of whom are predominantly employed in the informal economy through an erosion of their real incomes. The proportion of the working poor has increased markedly with average salaries lagging the poverty datum line (PDL). The average minimum wage in Zimbabwe as at November 2022 was about ZWL$98,000 (US$155 at the then prevailing official rate and US$131 using the then average black-market rate). In South Africa, according to the Quarterly Employment Statistics (QES) for March 2022, the average monthly earnings (including bonuses and overtime payments) was R23,502 (US$1,546) in February 2022. This creates strong economic incentives for Zimbabweans to seek greener pastures outside the country.

Promoting inclusive and sustainable economic growth, employment and decent work for all, remains one of the most daunting challenges facing the country. Even before the COVID-19 pandemic, economic growth in the country has not been fast and inclusive enough to absorb the growing labour force and to have a significant poverty reduction impact. The economy is officially projected to slow down to 3.8% in 2023 down from an estimated 4.0% in 2022. This is however strongly dependent on good rainfall which should have a positive impact on the agricultural sector as well as power generation at Kariba. In the short to medium term the economy will continue to face structural challenges arising from high levels of informality, high public debt, power outages, a fluid/uncertain political environment and institutional weaknesses. This will continue to weigh down on economic growth. The doing business environment remains very challenging. The country has however made some marginal progress in terms of doing business.

Zimbabwe continues to face huge labour market challenges related to poor job quality and high levels of working poverty. This situation is directly related to the high prevalence of informal and vulnerable employment. The country faces a scarcity of regular wage employment for all who would like wage jobs and have the relevant skills. Would-be wage employees cannot afford to remain unemployed and continue to search, so they find it better to create their employment opportunities in the informal economy. The percentage of informal employment has continued to increase from 75.6% in 2019 to 88% as at Q2 2022. Informal employment is often characterised by lower productivity, lower pay, limited social protection coverage, high levels of working poverty, poor working conditions and occupational safety and health (OSH) practices and general lack of rights. High levels of informality limit the capacity of the State to sustainably mobilise domestic resources and also effectively deploy micro and macroeconomic policies such as the National Budget to promote decent work. The lack of sufficient full, productive and decent jobs is complicating efforts to end poverty.

Review of Key Highlights

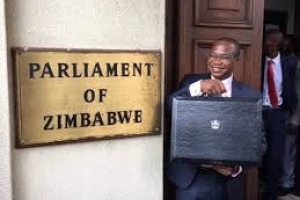

The Minister of Finance and Economic Development presented the 2023 National Budget to Parliament on Thursday 24 November. The 2022 National Budget is based on the theme, ‘Accelerating Economic Transformation.’ The 2023 National Budget is the third annual fiscal plan Government is using to implement the National Development Strategy 1: 2021-2025. The National Budget is anchored on an economic growth projection of 3.8% in 2023 slightly down from the estimated 4.0 in 2022. Under the NDS 1, the economic growth target for 2022 is 5.5% and it is 5.2% for 2023. While the country has made significant progress in mainstreaming employment creation within the National Development Strategy 1 (NDS 1), however employment targets and policies are not sufficiently integrated into the National Budget, the Monetary Policy, and other sectoral policies. It is important to improve the institutional framework for employment policy implementation, monitoring, evaluation, review and revisions. Enhancing employment-intensive works through continued expansion, rehabilitation, maintenance and improvements in the country’s infrastructure will help to boost private sector development, improve public services, and generate employment opportunities.

Total expenditures for the year 2023, are set at ZWL$4.5 trillion (including loan repayments of ZWL$248.6 billion) up from an estimated ZWL$2.1 trillion in 2022 which represents an increase of 114%. Projected recurrent expenditures of ZWL$3.6 trillion constitute 80% of the total expenditures, while employment costs of ZWL$2.2 trillion constitute 49% of the total expenditures. Projected capital expenditures of ZWL$657 billion represent 15% of the total expenditures. The overall budget deficit for 2023 is 1.5% up from a deficit of 0.61% in 2022. The financing of the budget deficit remains unsustainable on account of the limited fiscal space.

Review of the 2023 National Budget

Vote Allocations

The National Budget is an important instrument of resource allocation to ensure not just a rapid pace of Gross Domestic Product (GDP) growth, but also the achievement of important development imperatives such as price stability, employment creation and poverty reduction. The National Budget can enhance the quality/pattern of economic growth in the country through facilitating structural transformation, technological upgrading, and diversification by shifting resources from low value-added activities to those with higher value added. Such a bold transition necessitates prioritisation of both public resources and private investments in sectors with strong decent job creation potential, including the care economy, the health sector, the green economy, and education on a more significant scale than the current levels.

Enhancing public spending and investments in critical sectors of the economy such as social protection, health, education, agriculture, and infrastructure is critical to enhance the productivity of the workers. While there has been improved allocation and spending towards critical sectors of the economy such as health care and infrastructure, these improvements are still below regional and international benchmarks. Zimbabwe is a signatory to various regional and international agreements that provide benchmarks on budgetary allocation to fundamental socio-economic rights which are critical for the citizens in general and the working class in particular and include the right to: education; health; food and food security; water and sanitation among others. Without proper enjoyment of these rights, the citizens cannot live in dignity. Key sectoral spending targets/benchmarks that a National Budget must attain to demonstrate commitment and ensure the realisation of pro-poor, inclusive and sustainable growth and development include:

Table 1: Sectoral spending targets

Sector Agreement Target

Social protection Social Policy for Africa (2008) 4.5% GDP

Health Abuja Declaration (2001) 15% government expenditure

Education Education for All Initiative (2000) 20% government expenditure

Water & Sanitation eThekwini Declaration (2008)

Sharm El-Sheik Commitment (2008) 1.5% GDP

Agriculture Maputo Agreement (2003) 10% government expenditure

Infrastructure African Union Declaration (2009) 9.6% GDP

Primary and secondary education got the highest vote with an allocation of ZWL$631 billion which constitutes about 14% of total expenditures. This is an improvement from the estimated 13.4% in 2022, but it is still below the Dakar Declaration target of 20%. Health and Child care got an allocation of about ZWL$474 billion which constitutes about 10.5% of the total expenditures which is below the Abuja Declaration target of 15%. The Health and Child care vote translates to a per capita allocation of US$48. Government also spends a relatively small share of its Gross Domestic Product (GDP) on health care projected at 2.2% in 2022. The inadequate public financing of health has resulted in an overreliance on out-of-pocket and external financing which is highly unsustainable.

In general, social protection spending remains grossly inadequate to have a significant effect on poverty and vulnerability reduction. According to ILO statistics, social protection coverage in Zimbabwe is 16% which is way below the global average rate of 47%. Social protection was allocated about ZWL$50.4 billion which constitutes only 1.1% of total public expenditure and 0.2% of GDP down from 0.9% of GDP in 2022. Social protection allocation remains below the African Union (AU) Social Policy for Africa (2008) benchmark of at least 4.5% of GDP. With respect to water and sanitation, the country must spend at least 1.5% of GDP according to the eThekwini Declaration (2008) and the Sharm El-Sheik Commitment (2008). However, the country is projected to spend only 0.1% of GDP in 2023, down from an estimated 0.3% in 2022. Providing water and sanitation in schools is key to keeping girls and children in school. Poor and inadequate water and sanitation is a leading cause of poverty, morbidity, and mortality. On a positive development infrastructure spending for 2023 is projected at ZWL$1.1 trillion which constitutes 24% of the total expenditures and 5.3% of GDP up from 4.8% of GDP in 2022.

Review of Tax Measures

The reduction in the Intermediate Money Transfer Tax (IMTT) on domestic foreign currency transfers from 4% to 2% is a welcome development. The restoration of the Value Added Tax (VAT) to its pre-COVID-19 pandemic level of 15 from 14.5%. This will result in an increase in the cost of some goods and services by may increase by about 3.4%. The restoration of customs duty on basic commodities will result in an increase in the price of imported basic commodities. The excise duty on energy drinks which was introduced this year at a rate of US$0.05/litre, with a view to encourage responsible consumption of such products, as well as mobilise additional revenue to the Fiscus has been reviewed upwards to US$0.10 per litre, with effect from 1 January 2023. Additional funds generated from this must be ring-fenced and deployed towards the treatment of Non-Communicable Diseases (NCDs).

The tax-free threshold on local currency remuneration has been reviewed from ZWL$600,000 per annum (or ZWL$50,000 per month) to ZWL$900,000 per annum (or ZWL$75,000). The tax bands have will end at ZWL$12 million, above which tax will be levied at a rate of 40%. The review of the tax-free threshold to ZW$75,000 per month represents a 50% increase. This increase is way below the October 2022 annual inflation rate of 268.8%, implying that in real terms there is actually a decrease. The revised tax-free threshold is also below the average minimum wage of about ZWL$98,000 as at November 2022. Importantly, the revised tax-free threshold is grossly inadequate given the fact that the October 2022 Food Poverty Line (FPL) for an average family of 5 is ZWL$107,273 while the Poverty Datum Line (PDL) for an average household of 5 is ZWL$140,720.35. In view of the declining real wages and salaries owing to the chronic high inflation (the inflation tax) there is an urgent need to cushion workers through linking tax-free threshold to the Poverty Datum Line (PDL). Notwithstanding the revenue measures and incentives, the tax regime remains highly onerous and regressive resulting in an increase in cost of doing business as well as the erosion of real incomes.

Conclusion

Given the complexity and sensitivity of the structural challenges the country is facing and the inherent policy conflicts involved, we urge the authorities to urgently negotiate a Social Contract with issue-specific protocols to deal with the challenges in a holistic and integrated way. The adoption and implementation of the National Employment Policy anchored on broad-based social dialogue and consultations must also be prioritised as well as the reform of Parastatals in a socially sensitive and inclusive manner.